Rising rates: Short-term pain for long-term gain?

Brett Surman is a Financial Adviser with Gilkison Group.

Investors have likely noticed the improved opportunity in fixed income assets due to higher yields. And yet, some investors may be hesitant to take advantage of higher yields because of concerns about future increases in interest rates. Some may even be considering reducing their allocation to fixed income assets after this year’s negative returns for the bond market.

The good news?

If yields do keep rising, investors seeking higher expected returns may still be better off maintaining the duration of their fixed income portfolios.

Rising yields impact fixed income portfolios in several ways:

On the one hand, longer-duration portfolios (i.e. bonds with a maturity of several years) may experience larger immediate losses from increased yields compared to shorter-duration portfolios.

On the other hand, higher yields may lead to higher expected returns. Investors can think of this trade-off as a pit stop in a Formula 1 race. The pit stop immediately causes the driver to fall back. However, fresh tires may help the driver win the race if there are enough laps left to catch the leader.

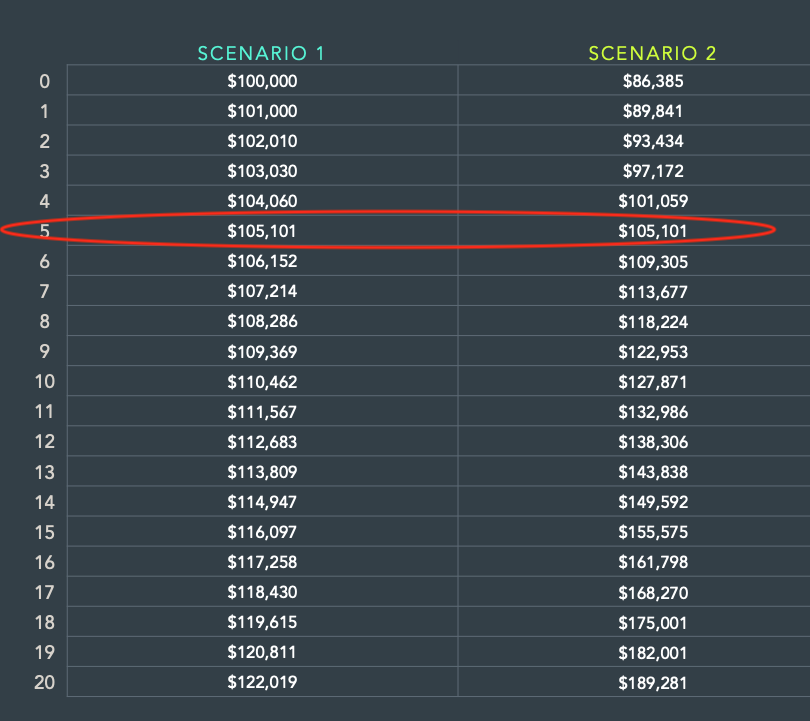

The table below illustrates this using two scenarios for a $100,000 bond with a 5-year duration (i.e. maturity) with income compounded annually.

- Scenario 1 assumes that you buy the bond and interest rates remain at 1% per annum throughout the entire 5-year period.

- Scenario 2 assumes that you buy the bond and after the first day interest rates immediately increase to 4% and remain at 4% throughout the remaining 5-year period.

In the second scenario, the sudden spike in interest rates results an immediate decline in the capital value from $100,000 to $86,385. However, despite the initial ‘gut punch’ to the value of the bond, the higher-yield environment accelerates Scenario 2’s recovery.

As seen in the table below, with a 4% yield rather than the previous rate of 1%, Scenario 2’s portfolio value overtakes Scenario 1’s value within five years — the time horizon determined by the bond duration.

When faced with uncertainty, investors should focus on the things they can control. Research tells us that trying to outguess the market by holding onto cash, or moving to a shorten bond duration, with the expectation of future yield increases may not help you achieve your long-term goals.

Markets quickly incorporate new information about higher interest rates and inflation. Investors who maintain appropriate asset allocations, even after increases in bond yields, may have a more rewarding investment experience in the long run.